Loading

Get Partnership- Forms - Sc Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Partnership- Forms - SC Department Of Revenue online

Filling out the Partnership- Forms - SC Department Of Revenue online can seem challenging, but with this guide, you will navigate the process smoothly. We'll break down each section of the form and provide clear, step-by-step instructions to ensure accurate and efficient completion.

Follow the steps to successfully complete the Partnership- Forms online.

- Use the ‘Get Form’ button to access the Partnership- Forms - SC Department Of Revenue and open it in your editor.

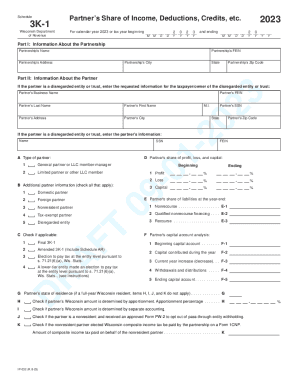

- In Part I, enter the information about the partnership. Fill in the partnership's name, FEIN (Federal Employer Identification Number), address, city, state, and zip code.

- Proceed to Part II and provide the necessary information about the partner, including their business name, last name, first name, address, city, state, and zip code. If the partner is a disregarded entity or trust, ensure to enter the taxpayer/owner's information.

- Select the type of partner from the options provided: general partner, limited partner, tax-exempt partner, or foreign partner. Be sure to check all applicable boxes regarding the partner.

- In Part III, document the partner's share of current year income, deductions, credits, and other items. Enter both federal amounts and Wisconsin amounts as prompted.

- In Part IV, if applicable, provide the partner's share of apportionment factors, detailing the method used for apportionment.

- In Part V, list any additions and subtractions required, including state taxes accrued and related entity expenses.

- Once all sections are completed, review your entries for accuracy. After confirming that all information is correct, you can save your changes, download the form, print it, or share it as needed.

Complete your Partnership- Forms - SC Department Of Revenue online now for a streamlined filing experience.

Purpose of Affidavit The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.