Loading

Get De Dor 1100-t-ext (formerly 1100-ext) 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DE DoR 1100-T-EXT (Formerly 1100-EXT) online

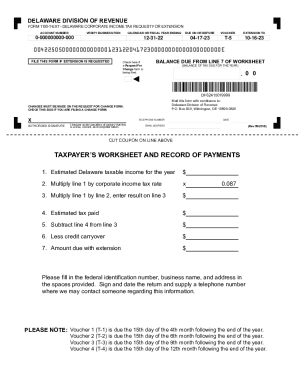

Filling out the DE DoR 1100-T-EXT form online is a crucial step for businesses seeking an extension for their corporate income tax. This guide provides a clear and comprehensive approach to complete this form accurately and efficiently.

Follow the steps to complete your extension request form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter your account number in the designated field, ensuring it is accurate to avoid processing delays.

- Provide your business's Federal Employer Identification Number (FEIN). This identifies your business for tax purposes.

- Indicate your calendar or fiscal year ending date in the appropriate section.

- Complete the line asking for the due date, which is typically the 15th day of the 4th month following the end of your fiscal year.

- Fill out the taxpayer’s worksheet, starting with the estimated Delaware taxable income for the year at the top of the section.

- Follow through the worksheet calculations, ensuring to multiply the estimated taxable income by the corporate income tax rate stated in the form.

- List the estimated tax paid, then subtract this amount from the calculated tax to find the balance due.

- If a change form is being filed concurrently, check the appropriate box before moving on.

- Finally, enter the required personal information including telephone number, signature, date, and email address, ensuring all entries are correct.

- Review all the information in the form, then save your changes. You may also download, print, or share the form as necessary.

Complete your DE DoR 1100-T-EXT form online to ensure your extension request is processed smoothly.

Related links form

Your Delaware extension request must be filed by the original deadline of your return. Delaware Tax Extension Tips: If you have a 6-month Federal tax extension (IRS Form 7004), the State of Delaware will automatically grant you a 6-month Delaware extension.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.