Get Nebraska Tax Application, Form 20

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Tax Application, Form 20 online

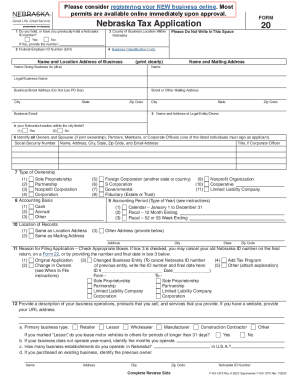

Filling out the Nebraska Tax Application, Form 20 is an essential step for individuals and businesses looking to obtain the necessary permits and licenses to conduct business in Nebraska. This guide provides clear, step-by-step instructions to help you navigate the form with ease.

Follow the steps to efficiently complete the Nebraska Tax Application, Form 20 online.

- Click ‘Get Form’ button to access the Nebraska Tax Application, Form 20, and open it in the digital editor.

- Indicate if you hold or have previously held a Nebraska ID number by selecting 'Yes' or 'No' and provide the number if applicable.

- Enter your Federal Employer ID Number (EIN) which you should have obtained prior to completing this application.

- Specify the county where your business is located within Nebraska.

- Provide the official name and physical address of your business. Avoid using a PO Box for the business street address.

- Fill in the legal name and mailing address. Ensure to enter the Street, City, State, and Zip Code accurately.

- Identify the name and address of the legal entity or owner, including their email and whether the Nebraska location is within city limits.

- List all individuals who are owners, partners, or corporate officers, including their Social Security numbers or titles as necessary.

- Select the type of ownership structure applicable to your business, which may include Sole Proprietorship, Partnership, Corporation, etc.

- Choose your accounting basis from options like cash, accrual, or other methods.

- Indicate your accounting period (calendar or fiscal) by selecting the relevant checkbox.

- Detail the location of your records, indicating if it is the same as your business address or another address.

- Select the reason for filing this application by checking the appropriate boxes provided.

- Provide a brief description of your business operations, products, and services. Include your website URL if applicable.

- Complete any additional required fields, such as tax program selections related to sales, income, and miscellaneous taxes.

- Designate a contact person for this application by entering their details, including title, email, and phone number.

- Affix your signature and date the application, confirming the information is complete and accurate.

- Save your changes, download or print the completed form, or share it as required.

Begin completing the Nebraska Tax Application, Form 20 online today to ensure your business complies with all necessary regulations.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

Fill Nebraska Tax Application, Form 20

If you purchased an existing business, identify the previous owner. FORM. 20. Complete Reverse Side. Name. Address. City. How to Apply for Nebraska Tax Programs. PART I: The Nebraska Tax Application, Form 20, is used for the following tax programs: Sales and Use Tax. Form 20: Nebraska Tax Application – Nebraska Form required to obtain a sales tax permit. New Password and Confirm Password are required. New Password and Confirm Password must match. You can either register online through the state's secure online portal or complete and submit the Nebraska Tax Application, Form 20. A business must file the Nebraska Tax Application (Form 20) to receive a Nebraska Sales Tax ID Number and PIN. A business must file the Nebraska Tax Application (Form 20) to receive a Nebraska Sales Tax ID Number and PIN.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.