Loading

Get Sec. 03.04.12.04. Certificate Of Full Or Partial Exemption ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sec. 03.04.12.04. Certificate Of Full Or Partial Exemption online

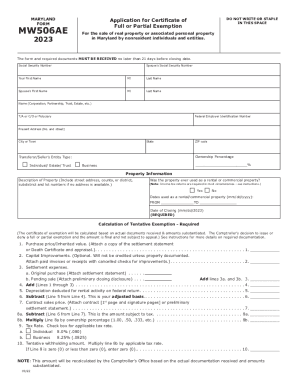

Filling out the Sec. 03.04.12.04. Certificate Of Full Or Partial Exemption is essential for obtaining an exemption from withholding taxes during the sale of real property in Maryland. This guide provides clear, step-by-step instructions for completing the form online, making the process accessible for all users.

Follow the steps to fill out the Certificate Of Full Or Partial Exemption form efficiently

- Click ‘Get Form’ button to obtain the form and access it for editing.

- Begin with the Transferor/Seller's Information. Enter your full name and, if applicable, your spouse's name. Include Social Security Numbers where required.

- Provide the name of any entity such as corporation or trust, along with the Federal Employer Identification Number.

- Fill in your current address including street, city, state, and ZIP code.

- Indicate your ownership percentage and select the transferor/seller’s entity type from the available options.

- Move to the Property Information section. Describe the property, including its street address and any lot numbers.

- Specify if the property was ever used as rental or commercial property by selecting 'Yes' or 'No'. Provide dates used, if applicable.

- For Calculation of Tentative Exemption, complete lines for purchase price, capital improvements, and settlement expenses, ensuring to attach necessary documentation.

- Continue with the calculations through lines 4 to 10, ensuring you complete each section accurately.

- In the Special Situations section, check any applicable boxes that correspond to your situation.

- Enter the details for the Settlement Agent to mail the certificate if issued, including their name and contact information.

- Sign and date the application, and ensure that if any preparer is involved, all relevant information and signatures are included.

- Finally, save changes to your form, download it for your records, or print it out. You may also share the completed form for mailing to the appropriate office.

Complete your application online today to ensure timely processing of your Certificate of Full or Partial Exemption.

Related links form

Use Form 590, Withholding Exemption Certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments for wages to employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.