Loading

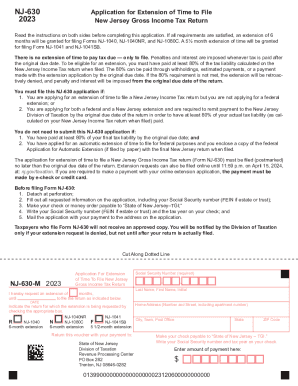

Get State Of New Jersey Application For Extension Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of New Jersey APPLICATION FOR EXTENSION OF TIME online

This guide provides you with clear and comprehensive instructions for successfully completing the State Of New Jersey Application for Extension of Time to File your Gross Income Tax Return. By following these steps, you will ensure that you complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the application form and open it for editing.

- Carefully read the instructions provided on both sides of the application to understand the requirements for obtaining an extension.

- Fill in all requested personal information on the application, including your Social Security number, your last name, first name, and any initials.

- Enter your home address, ensuring to include the apartment number if applicable.

- Select the type of return for which you are requesting an extension by checking the appropriate box (NJ-1040, NJ-1040NR, NJ-1080C, NJ-1041, or NJ-1041SB), and indicate the duration of the extension.

- If a payment is required, write the amount of payment on the form and ensure that your check or money order is made payable to 'State of New Jersey – TGI'. Don’t forget to write your Social Security number and the tax year on your payment.

- Detach the form at the perforation if applicable, and prepare to submit it with your payment.

- Mail the completed application along with the payment to the address provided on the application form, ensuring it is postmarked by the original due date.

- After submitting, remember that users do not receive a copy of the approved form; instead, you will be informed by the Division of Taxation only if your request is denied.

Complete your documents online today to ensure timely submission!

Submit Form 4868 to the IRS either electronically or via mail by the tax filing deadline. If you pay the IRS an estimate of your taxes owed by tax day using either your debit/credit card, IRS Direct Pay, or the EFTPS system, noting that your payment is for an extension, you can skip the paperwork altogether.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.