Loading

Get R-1367 (7/18)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R-1367 (7/18) online

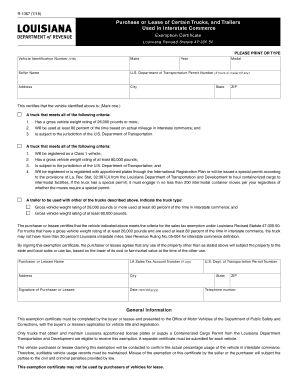

The R-1367 (7/18) is an exemption certificate used for the purchase or lease of certain trucks and trailers utilized in interstate commerce. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you complete it accurately and effectively.

Follow the steps to successfully complete the R-1367 (7/18) online.

- Click the ‘Get Form’ button to access the exemption certificate and open it for completion. This allows you to fill out the necessary fields directly.

- Begin by entering the vehicle identification number (VIN) in the designated field. Ensure that this number is accurate, as it uniquely identifies the vehicle.

- Fill in the make of the vehicle, specifying the manufacturer. Follow this by providing the year and model of the vehicle in their respective fields.

- Enter the seller's name, including any relevant business name if applicable, to identify the party selling or leasing the vehicle.

- If applicable, provide the U.S. Department of Transportation Permit number for the truck or trailer. This detail helps in verifying the vehicle's compliance with transportation regulations.

- Complete the address section, including the street address, city, state, and ZIP code of the seller or leasing party.

- Select the appropriate criteria for the vehicle by marking one of the options provided. Be sure to understand the criteria for each vehicle category before selection.

- In the section for vehicle usage claims, confirm that the vehicle meets the criteria for the sales tax exemption under Louisiana Revised Statute 47:305.50 by reading the requirements carefully.

- Fill in the name and address of the purchaser or lessee, followed by their Louisiana Sales Tax Account Number, if they have one.

- Ensure to provide the signature of the purchaser or lessee in the designated area, along with the date of signing in the mm/dd/yyyy format.

- Add the U.S. Department of Transportation Permit number again if applicable, and fill out the state, ZIP code, and telephone number.

- After carefully reviewing the filled-out form for accuracy, you can save your changes, download the completed document, print it for your records, or share it as needed.

Start filling out your R-1367 (7/18) exemption certificate online to ensure efficient processing of your vehicle purchase or lease.

Yes, sales to churches and nonprofit organizations are subject to sales tax unless they are specifically exempted by statute. The designation of tax-exempt status by the IRS provides for an exemption only from income tax and in no way applies to sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.