Get Application For Property Tax Exemption. Application For Property Tax Exemption - Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Property Tax Exemption online

This guide provides clear, step-by-step instructions for effectively completing the Application For Property Tax Exemption. Understanding the requirements and sections of the form will help ensure a successful submission for the property tax exemption you are seeking.

Follow the steps to complete your application for property tax exemption.

- Press the ‘Get Form’ button to access the application form and open it in your editing tool.

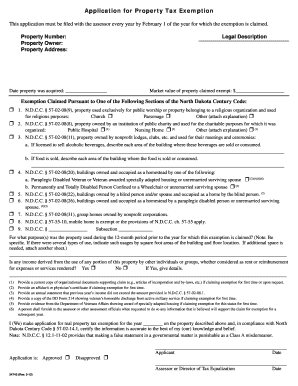

- Begin by entering the property number, name of the property owner, and the complete property address in the designated fields.

- Fill in the date the property was acquired in the appropriate space.

- Provide a legal description of the property, ensuring it accurately reflects the property's identity.

- Enter the market value of the property you are claiming as exempt in the specified section.

- Select the exemption you are claiming by marking the corresponding checkbox. Ensure you read each section of the North Dakota Century Code that applies.

- If applicable, provide details about areas of the building where food or drinks are sold or consumed by filling in the respective prompts.

- If relevant, address the purpose for which the property was used during the past twelve months with detailed information based on usage.

- Indicate whether any income has been derived from the property and provide explanations as necessary.

- Attach any required organizational documents, affidavits, or evidentiary materials based on your claim for exemption.

- Sign and date the application, certifying that the information provided is accurate to the best of your knowledge.

- Upon completion, save the changes to your document. You may then download, print, or share the application for submission.

Submit your application for property tax exemption online today.

Homeowners in North Dakota face a single tax rate, which is the total of the rates levied by all the tax authorities in their area. This rate is expressed in mills. A mill is equal to 1/10th of a percent, or $1 of tax per $1,000 in taxable value. Another way of calculating tax rates is as effective rates. North Dakota Property Tax Calculator - SmartAsset smartasset.com https://smartasset.com › taxes › north-dakota-property-ta... smartasset.com https://smartasset.com › taxes › north-dakota-property-ta...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.