Loading

Get Business Financing Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Financing Application online

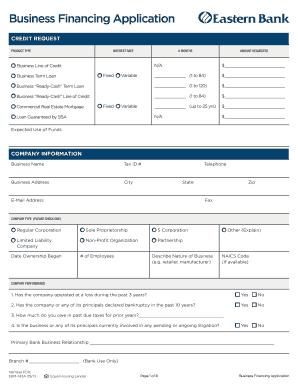

Filling out the Business Financing Application online is an essential step in securing financing for your business. This guide provides clear and supportive instructions to help you accurately complete each section of the form, ensuring a smooth submission process.

Follow the steps to complete the application effectively.

- Click the ‘Get Form’ button to retrieve the Business Financing Application and open it in the respective editor.

- Begin with the credit request section. Select the product type you wish to apply for, such as a term loan or line of credit. Indicate the interest rate and specify the number of months for repayment. Enter the amount you are requesting clearly in the designated field.

- In the expected use of funds section, briefly describe how you intend to use the funds you are requesting.

- Provide your company information, including the business name, tax identification number, address, and contact details. Select your company type from the provided options, such as sole proprietorship or corporation.

- Fill out the company performance section by answering the questions regarding past financial performance, liabilities, and any ongoing litigation.

- Complete the owner information section for all partners or stockholders. Include personal details such as name, title, home telephone number, and percentage of company ownership.

- Detail your schedule of business debt, listing creditors, dates opened, monthly payments, and amounts past due as applicable.

- Provide a personal financial statement, including all relevant personal assets and liabilities. Ensure to capture current balances and collect necessary financial documents.

- Review the income and expenditure statement, providing estimated amounts for income and expenses for both the applicant and co-applicant, if applicable.

- Complete all other required schedules, including those for assets, liabilities, and any significant investments.

- Read and agree to the terms in the agreement of borrower section. Make sure to complete any necessary signatures for yourself and any co-applicants.

- Finally, save your changes, download the completed application, print it for your records, or share it as needed.

Begin filling out the Business Financing Application online today to advance your business financing process.

The typical business loan from a bank or credit union can take weeks or months to process. Fast business loans, on the other hand, may be funded within a week of submitting an application. Some lenders are able to assess and underwrite loans in a matter of hours and fund them within a day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.