Loading

Get What's The Difference Between 'recordkeeping' And Administration?

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What's The Difference Between 'Recordkeeping' And Administration? online

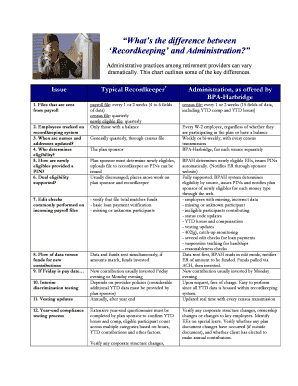

This guide aims to provide users with a clear understanding of the differences between recordkeeping and administration practices. By following this comprehensive step-by-step approach, users can effectively fill out the form online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Review the sections of the form that outline key differences between recordkeeping and administration. Pay close attention to the issues listed to understand the administrative practices in place.

- Complete any required fields based on your organization’s practices. This includes entering details related to payroll files, census files, and other relevant data that may vary from recordkeeper to administration practices.

- Verify eligibility criteria according to your organization’s policies. Take note of who is responsible for determining eligibility and how PINs are issued for newly eligible participants.

- Provide accurate information for edit checks and compliance testing. This is crucial for ensuring the integrity of data and meeting regulatory requirements.

- Once all fields are filled out, review your entries for accuracy. Ensure that all necessary documentation is included in the submission.

- Finalize the process by saving changes. After reviewing, you can download, print, or share the completed form as needed.

Start completing your documents online today for seamless recordkeeping and administration management.

In addition to tracking individuals' assets, recordkeepers often provide other services. It's not uncommon for recordkeeping fees to include: Maintaining a website to check 401(k) balances and make transfers. Printing and mailing account statements to employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.