Loading

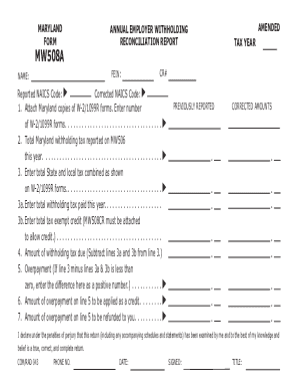

Get Tax Year 2023 - Form Mw508a Annual Employer Withholding Reconciliation Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Year 2023 - Form MW508A Annual Employer Withholding Reconciliation Report online

The Tax Year 2023 - Form MW508A Annual Employer Withholding Reconciliation Report is an essential document for employers to reconcile withholding tax for the year. This guide provides a clear and concise step-by-step process to assist you in accurately completing the form online.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Federal Employer Identification Number (FEIN) in the designated field.

- Provide your name in the specified field.

- Indicate if this is an amended return by checking the appropriate box.

- List the tax year for which you are filing the reconciliation.

- Enter the Corrected NAICS Code if applicable, and include the Previously Reported NAICS Code.

- Attach the Maryland copies of W-2/1099R forms and enter the total number of forms attached.

- Input the Total Maryland withholding tax reported on MW506 this year.

- Enter the total State and local tax combined as shown on the W-2/1099R forms.

- Provide the total withholding tax paid this year in the designated space.

- If applicable, enter the total tax exempt credit after attaching MW508CR.

- Calculate the Amount of withholding tax due by subtracting lines 3a and 3b from line 3.

- If the outcome from line 5 is negative, enter the overpayment as a positive number.

- Indicate how much of the overpayment should be applied as a credit.

- Specify the amount of overpayment you wish to be refunded.

- Complete the declaration section, including your phone number, date, signature, and title.

- Review the entire form for accuracy before saving, downloading, printing, or sharing.

Complete your forms online to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In 2023, it doesn't matter if you claim 1 or 0 on your W-4. Your taxes will not be affected because you can no longer claim allowances. In the past, claiming one allowance meant that a little less tax was withheld from your paycheck over the year than if you'd claimed zero allowances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.