Loading

Get Homestead Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Homestead Application online

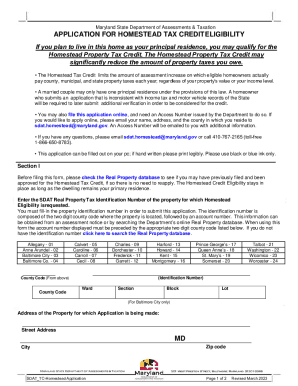

The Homestead Application allows homeowners to apply for property tax credits that can significantly reduce tax liabilities on their principal residence. This guide provides clear and detailed instructions for filling out the application online, ensuring you understand each component of the process.

Follow the steps to complete the Homestead Application effectively.

- Click ‘Get Form’ button to obtain the Homestead Application and access it for completion.

- Before you start, verify if you have previously filed for the Homestead Tax Credit using the Real Property database. If approved, reapplication is not necessary.

- In Section I, enter the Real Property Tax Identification Number for your home. This number consists of the two-digit county code followed by your account number.

- Next, fill out your property's address. Ensure you include the street address, city, and zip code accurately.

- Move to Section II and answer all questions regarding the use of your property and provide the Social Security numbers of all homeowners, including spouses, even if not listed as owners on the deed.

- Complete all sections related to your residency status, including whether you expect to file your income taxes from this address and if you are registered to vote here.

- If applicable, indicate whether any portion of the principal residence is rented. All owners must provide their printed names and Social Security numbers.

- Upon finalizing the application, review all entered information for accuracy. Make sure to sign and date the application before submission.

- Submit the completed application to the Department of Assessments and Taxation at the specified address or through the provided online method, if available.

Complete your Homestead Application online today to secure your property tax benefits.

The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.