Loading

Get For Estate Tax Extension Request, Complete Section ... - Ct.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Estate Tax Extension Request, Complete Section ... - CT.gov online

Filling out the estate tax extension request form can seem daunting, but this comprehensive guide will help you navigate each section with ease. Whether you are a first-time user or have prior experience, our supportive instructions will ensure you complete the form accurately and efficiently.

Follow the steps to effectively complete the form online.

- Press the ‘Get Form’ button to access the estate tax extension request form and open it in your preferred editor.

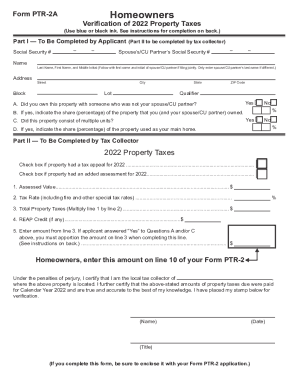

- Begin with Part I, where you will enter your personal details including your Social Security number. If you are married or in a civil union, include your partner’s Social Security number as instructed.

- Proceed to fill in your name and address accurately. Ensure that the details match the property for which you are requesting the extension.

- Complete the section regarding the ownership of the property. Indicate whether you owned the property with someone who is not your spouse or civil union partner. If yes, provide the percentage share of the property owned by you and your partner.

- If the property is a multi-unit structure, indicate this in the designated area and specify the percentage of the property used as your main home.

- Move on to Part II to be completed by the tax collector. Ensure all property-related taxes for the year 2022 are correctly entered, such as the assessed value, tax rate, and total property taxes due.

- Verify any applicable deductions or credits that may apply to your situation, and calculate the final amounts as needed.

- Conclude by signing and dating the certification section of the form. Use blue or black ink and ensure the stamp is placed where required.

- Finally, save your changes, download the completed form, and print or share it as necessary.

Complete your estate tax extension request online today!

Mail paper return CT-1120 EXT with payment to: Department of Revenue Services, State of Connecticut, PO Box 2974, Hartford, CT 06104‑2974. Mail paper return CT-1120 EXT without payment to: Department of Revenue Services, State of Connecticut, PO Box 150406, Hartford, CT 06115‑0406.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.