Loading

Get Reg-1e - Application For St-5 Exempt Organization Certificate Form ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reg-1E - Application For ST-5 Exempt Organization Certificate Form online

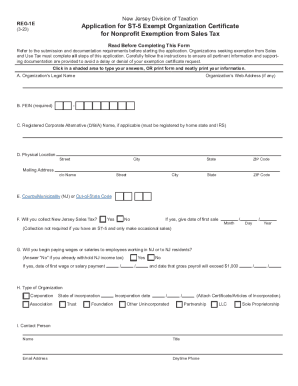

Filling out the Reg-1E application for an ST-5 exempt organization certificate is an essential step for nonprofit organizations seeking exemptions from New Jersey sales tax. This guide will walk you through the process of completing the form online, ensuring all necessary information is provided to facilitate a smooth application process.

Follow the steps to successfully complete the Reg-1E application online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the organization’s legal name exactly as it appears in your organizing documents in Section A. If applicable, include the organization’s web address.

- In Section B, provide the Federal Employer Identification Number (FEIN). This number is essential for processing your application.

- If your organization has a registered corporate alternative name in Section C, enter it here. Ensure this name is registered with your home state.

- Complete Section D with the physical location of the organization, including the street address, city, state, and ZIP code. Ensure this is accurate as the ST-5 certificate will be sent to this address.

- In Section E, input the appropriate county or municipality code, as required.

- Section F asks whether your organization will collect New Jersey Sales Tax. Select 'Yes' or 'No' and provide the date of the first sale if applicable.

- Section G inquires if you will begin paying wages in New Jersey; select accordingly and provide relevant dates.

- In Section H, indicate the type of organization by checking the corresponding box and providing additional information as required.

- Complete Section I with the name, title, email address, and phone number of a contact person who can help with inquiries regarding the application.

- In Section J, detail the information for responsible officers, including their names, Social Security numbers, titles, and home addresses.

- Provide a summary of your organization’s primary purpose in Section K by selecting the appropriate exemption purpose box.

- In Section L, indicate if your organization will receive group exemption status from a central organization by selecting 'Yes' or 'No.'

- Specify whether you elected under Section 501(h) of the Internal Revenue Code in Section M.

- Certify the application by providing your signature and printing your name and title. Ensure to include the date.

- After completing the form, review all entries for accuracy and completeness before saving your changes.

- Download or print the completed Reg-1E application, and prepare any necessary supporting documents for submission.

- Submit the application and supporting documents online as instructed on the New Jersey Division of Taxation website.

Begin filling out your Reg-1E application online today to secure your exemption status efficiently.

Related links form

It is not necessary to give the seller a new certificate every time a purchase is made because the certificates do not expire. Although certificates of exemption do not actually expire, New Jersey recommends that it would be good business practice for a seller to request a new form at least every few years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.