Loading

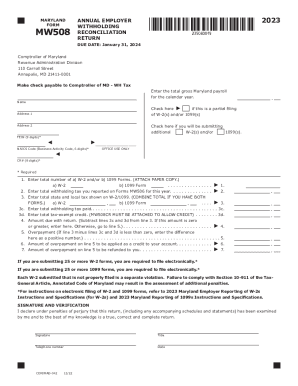

Get Tax Year 2023 - Form Mw508 Annual Employer Withholding Reconciliation Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Year 2023 - Form MW508 Annual Employer Withholding Reconciliation Return online

This guide provides comprehensive instructions on filling out the Tax Year 2023 - Form MW508 Annual Employer Withholding Reconciliation Return online. It aims to simplify the process for all users, regardless of their prior experience with tax forms.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the section for total gross Maryland payroll for the calendar year by entering the appropriate figure on the designated line.

- Indicate whether this is a partial filing by checking the box if applicable; also check if you will be submitting additional W-2s and/or 1099s.

- Enter your Federal Employer Identification Number (FEIN) as a nine-digit number.

- Input your NAICS Code, which is a six-digit Business Activity Code.

- Report the total number of W-2 and 1099 forms attached by filling out lines 1a and 1b and providing the combined total on line 1.

- Detail the total withholding tax you reported on Forms MW506 for the year on line 2.

- For line 3, enter the total state and local tax shown on W-2s and/or 1099 forms, including combining totals where necessary.

- On line 3c, enter the total withholding tax you have paid, and for line 3d, enter any eligible tax-exempt credits. Attach Maryland Form MW508CR if applying for any credit.

- Calculate the amount due on line 4 by subtracting lines 3c and 3d from line 3; if this amount is zero or greater, enter it here.

- If the result from line 3 is less than zero, enter the positive difference as an overpayment on line 5.

- Indicate on line 6 the amount of overpayment to be credited to your account.

- Specify on line 7 the amount of overpayment you wish to be refunded.

- After completing the form, review all entries for accuracy, then save changes, and choose to download, print, or share the form as needed.

Complete your Tax Year 2023 - Form MW508 Annual Employer Withholding Reconciliation Return online today for a hassle-free filing experience.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.