Loading

Get Fl Dor Dr-26s 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DoR DR-26S online

This guide will provide you with detailed instructions on how to complete the FL DoR DR-26S application for refund for sales and use tax online. By following these steps, you will ensure that your application is accurately filled out and ready for submission.

Follow the steps to successfully fill out the FL DoR DR-26S

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

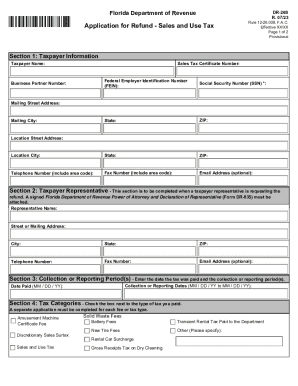

- Begin by filling out Section 1: Taxpayer Information. Include your taxpayer name, sales tax certificate number, Federal Employer Identification Number (FEIN), social security number (SSN), state, ZIP code, location city, state, ZIP code, telephone number, fax number, email address (optional), business partner number, mailing street address, and mailing city.

- If applicable, complete Section 2: Taxpayer Representative. This section is required when a representative is submitting the refund request on behalf of the taxpayer. Include the representative's name, street or mailing address, city, state, ZIP, telephone number, fax number, and email address (optional). Remember to attach a signed Power of Attorney and Declaration of Representative form (DR-835).

- In Section 3: Collection or Reporting Period(s), enter the dates related to the tax payment and collection period. Use the MM / DD / YY format for both 'Collection or Reporting Dates' and 'Date Paid'.

- Proceed to Section 4: Tax Categories. Check the box corresponding to the type of tax you have paid. Note that a separate application must be filed for each tax type.

- In the same section, indicate the reason for your refund claim by checking the appropriate box for reasons such as amended replacement return, duplicate payment, or audit overpayment.

- In Section 5: Refund Amount, enter the specific amount you are claiming for a refund. Provide a brief explanation for the refund claim in the designated field.

- Finally, complete the Authorization and Signature section. You must sign and date the application as either the taxpayer or the representative, ensuring that all information is correct.

- After completing the form, you can save changes, download, print, or share it as needed, and submit it to the provided mailing address or fax number for processing.

Get started on filing your FL DoR DR-26S application online today!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.