Loading

Get Form M-990t-62 Exempt Trust And Unincorporated ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

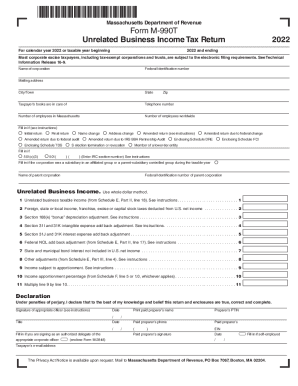

How to fill out the Form M-990T-62 Exempt Trust and Unincorporated Entities online

This guide provides step-by-step instructions for completing the Form M-990T-62 for exempt trusts and unincorporated entities online. Whether you are familiar with tax forms or new to this process, this comprehensive guide is designed to assist you.

Follow the steps to complete your Form M-990T-62 online with ease.

- Click the ‘Get Form’ button to download the Form M-990T-62 and open it in your preferred editor.

- Fill in the name of the corporation in the designated field, followed by the federal identification number. Ensure all information is accurate to avoid issues.

- Enter the mailing address, including city/town, state, and zip code. This ensures proper correspondence regarding your filing.

- Indicate whether this is the initial return, final return, name change, or an amended return by placing a check mark in the appropriate box.

- Complete the section regarding unrelated business income. Use the whole dollar method as instructed, and fill in the total taxable income from Schedule E.

- Sign and date the form in the declaration area, making sure to include the title of the individual signing. This step is critical as it confirms the accuracy of the information provided.

- If a paid preparer is involved, include their information, including the phone number and EIN, and ensure they sign the form as well.

- Review all sections for completeness and accuracy before proceeding. This is essential to ensure smooth processing of your document.

- Once complete, save your changes, and prepare to download, print, or share the form as required.

Start completing your Form M-990T-62 online today for a smooth filing experience.

Related links form

1 - Income Tax on Trusts and Estates (1)Jurisdiction over Trusts for Taxation. (a)Testamentary Trusts. Trusts created under the will of a person who died a resident of Massachusetts are subject to the taxing jurisdiction of Massachusetts with respect to all of their taxable income from whatever source derived.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.