Loading

Get Form Ebf-1 Business Income Verification - State Of New Jersey

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM EBF-1 Business Income Verification - State Of New Jersey online

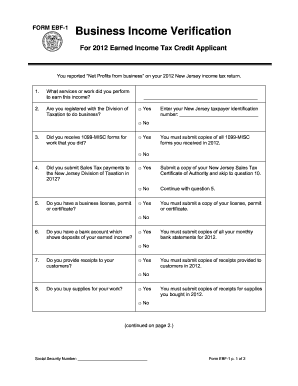

The FORM EBF-1 Business Income Verification is an important document for applicants of the Earned Income Tax Credit in New Jersey. This guide provides a detailed overview and step-by-step instructions on how to successfully complete this form online.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, provide information about the services or work performed to earn income. Include specifics about your business activities.

- Indicate if you are registered with the Division of Taxation by marking 'Yes' or 'No'. If 'Yes', enter your New Jersey taxpayer identification number.

- Answer whether you received 1099-MISC forms for your work. If 'Yes', you must submit copies of all 1099-MISC forms received in 2012.

- Respond to whether you submitted Sales Tax payments. If 'Yes', include a copy of your New Jersey Sales Tax Certificate of Authority.

- State if you have a business license, permit, or certificate. If applicable, submit a copy of the document.

- Indicate whether you have a bank account showing deposits of your earned income. If 'Yes', submit copies of all monthly bank statements for 2012.

- Answer if you provide receipts to customers. If 'Yes', include copies of the receipts issued in 2012.

- State if you purchase supplies for your work. If 'Yes', submit copies of receipts for supplies bought in 2012.

- Provide a list of your main clients or customers during 2012. For each client, fill in the required fields including name, address, contact number, how often you worked for them, and payment details.

- Affirm that all information in the document is true under penalties of perjury. Complete your name, signature, Social Security number, date, daytime contact number, and primary work location.

- Once all sections are filled out, you can save changes, download, print, or share the form as needed.

Complete the FORM EBF-1 online to ensure a smooth verification process for your business income.

The deduction limit is usually 50% of the cost of the meal. Qualifying for the enhanced deduction. To qualify for the enhanced business meal deduction: The business owner or an employee of the business must be present when food or beverages are provided.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.