Loading

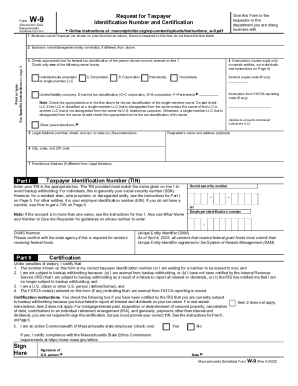

Get Form W9 Request For Taxpayer Identification And Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W9 Request For Taxpayer Identification And Certification online

Filling out the Form W9 Request For Taxpayer Identification And Certification online is a straightforward process that helps individuals and entities provide their correct taxpayer identification information. This guide aims to assist users with a clear and concise step-by-step approach to ensure accuracy and compliance.

Follow the steps to fill out the Form W9 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in an editing platform.

- Enter the business name or taxpayer name as shown on your income tax return in the first line. Ensure this name is accurate as it is mandatory.

- If applicable, provide any alternative business name or 'doing business as' (DBA) name in line 2.

- Select the appropriate box that indicates the federal tax classification on line 3. Only choose one option, such as Individual, Corporation, Partnership, etc.

- If you qualify for any exemptions from backup withholding or FATCA reporting, enter the appropriate code on line 4.

- Provide your legal address on line 5, ensuring it is where the requester will send your information returns.

- Fill in the city, state, and ZIP code in line 6 corresponding to your legal address.

- If you have a different remittance address, provide that information on line 7.

- In Part I, enter your taxpayer identification number (TIN) in the corresponding box. Use your social security number (SSN) for individuals or your employer identification number (EIN) for businesses.

- In Part II, complete the certification statements. Ensure to sign and date the form at the indicated lines.

- Once completed, review the form for any errors, then save your changes, and choose to download, print, or share the form as necessary.

Take action now and complete your Form W9 online to ensure prompt processing of your taxpayer information.

The form, officially called Form W-9, Request for Taxpayer Identification Number and Certification, is typically used when a person or entity is required to report certain types of income. The form helps businesses obtain important information from payees to prepare information returns for the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.