Loading

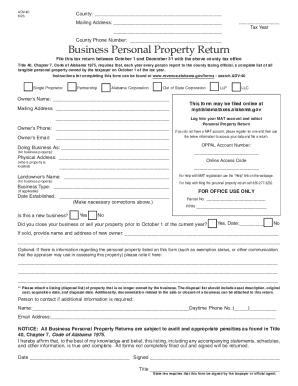

Get File This Tax Return Between October 1 And December 31 With The Above County Tax Office

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the File This Tax Return Between October 1 And December 31 With The Above County Tax Office online

Filing your business personal property tax return is essential for compliance with local tax regulations. This guide will help you understand the process involved in completing the File This Tax Return Between October 1 And December 31 With The Above County Tax Office form online.

Follow the steps to successfully complete your tax return form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your county and tax year in the designated fields at the top of the form. This information is crucial for processing your return correctly.

- Provide your mailing address, including the street address, city, state, and zip code, in the specified areas below the county information.

- Fill in your phone number and email address. This information will be used for any follow-up communication required by the tax office.

- Indicate the name under which your business operates, known as 'Doing Business As', in the appropriate field.

- If applicable, enter your OPPAL account number, which is necessary for retrieving your business property data.

- Complete the owner’s section with your name, address, phone number, and email.

- Select your business type, such as corporation or partnership, by checking the appropriate box.

- In Part A, provide an itemized statement of personal property you own as of October 1. List details such as items, date acquired, and cost.

- In Part B, if you own any licensed motor vehicles with specialized equipment, complete the relevant details including model year, make, tag number, and purchase price.

- Complete Parts B-1, C, D, E, and F as necessary, providing accurate information about trailers, aircraft, construction in progress, leased items, and other personal property.

- Finally, review all entered information for accuracy. Once confirmed, save changes, download, print, or share the completed form as needed before submission.

Ensure compliance and ease of filing by completing your document online today.

A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. These commonly include things like significant amounts of interest income, mortgage interest or charitable contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.