Loading

Get 2022 Form 1040 Social Security Worksheet - Fill Online ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

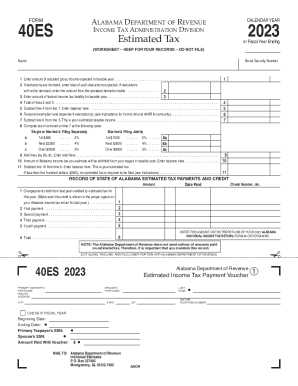

How to fill out the 2022 Form 1040 Social Security Worksheet - Fill Online

Filling out the 2022 Form 1040 Social Security Worksheet online can be made straightforward with the right guidance. This comprehensive guide provides step-by-step instructions to assist you in successfully completing the form.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the worksheet and open it in your document editor.

- Locate the section for personal information. Enter your name and Social Security number accurately in the designated fields.

- For line 1, provide the amount of adjusted gross income you expect for the taxable year. This figure is critical for calculating your overall tax responsibility.

- On line 2, if you will be itemizing deductions, enter the total amount expected; if not, refer to the standard deduction table and enter that figure.

- For line 3, enter your anticipated federal income tax liability for the taxable year.

- Add the values from lines 2 and 3 together and input the total on line 4.

- Subtract the total from line 4 from the amount you entered on line 1 and enter this balance on line 5.

- On line 6, input your personal exemption and any dependent exemption amounts.

- Subtract the amount on line 6 from line 5 and write the result on line 7. This represents your estimated taxable income.

- For line 8, compute your tax based on the rates provided for your specific filing status and sum these amounts.

- Next, on line 10, indicate any Alabama income tax you predict will be withheld from your wages.

- Finally, subtract line 10 from line 9 and enter the result on line 11. If this amount is less than $500, you will not be required to file estimated tax.

- Review all input for accuracy before saving. You can then download, print, or share the completed form as needed.

Complete your forms online to ensure a smooth filing process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Income Taxes and Your Social Security Benefit (En español) Between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. More than $34,000, up to 85% of your benefits may be taxable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.