Loading

Get In State Form 42850 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 42850 online

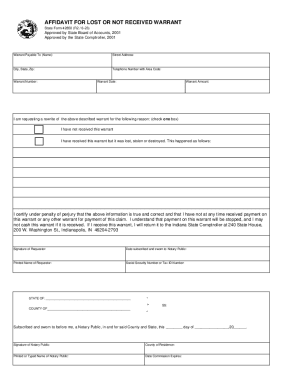

Filling out the IN State Form 42850, an affidavit for a lost or not received warrant, can be done efficiently online. This guide provides step-by-step instructions to ensure that users can complete the form accurately and with confidence.

Follow the steps to fill out the IN State Form 42850 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the warrant payable to name. This should be the name of the person or entity to whom the warrant is issued.

- Next, fill in the street address, city, state, and zip code of the above-mentioned individual or entity.

- Provide a telephone number with the area code where you can be reached.

- Enter the warrant number associated with the lost or not received warrant.

- Detail the warrant amount that is stated on the warrant, and the warrant date when it was originally issued.

- Indicate the reason for requesting a rewrite of the warrant by checking the appropriate box: either you have not received the warrant or have received it but it was lost, stolen, or destroyed. Provide a description of the incident if applicable.

- Certify the accuracy of your information by signing in the signature of the requestor field, including the date when you are swearing to the document.

- Fill in your printed name and provide your social security number or tax ID number.

- Complete the notary section by providing the county and state where the affidavit is being sworn. The notary public will sign and print their name, along with indicating the expiration date of their commission.

- Once all fields are completed, review the entire form for accuracy. You can then save changes, download, print, or share the finalized document as needed.

Complete your documents online today to ensure a smooth and efficient process.

Related links form

You have a couple options for filing and paying your Indiana sales tax: File online at the Indiana Department of Revenue. You can remit your tax bill through their online system. AutoFile – Let TaxJar file your sales tax for you. Guide and Calculator 2022 Indiana Sales Tax - TaxJar taxjar.com https://.taxjar.com › sales-tax › indiana taxjar.com https://.taxjar.com › sales-tax › indiana

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.