Loading

Get Ca Ftb 540x 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540X online

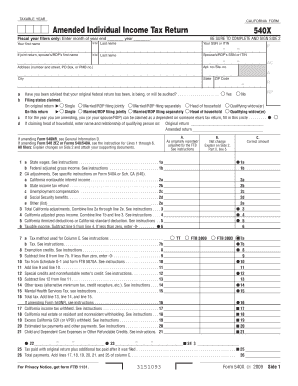

The California Form 540X is an amended individual income tax return that allows users to correct errors or make adjustments to a previously filed Form 540. This guide provides clear, step-by-step instructions for completing the form online.

Follow the steps to complete your amended return effectively.

- Press the ‘Get Form’ button to access the amendment form and open it in your preferred online editor.

- Provide your personal information, including your first name, last name, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If filing jointly, include your spouse's or registered domestic partner's (RDP) details.

- Specify your address including street number, street name, apartment number, city, state, and ZIP code.

- Indicate if you have been advised that your original federal return is being audited.

- Select your filing status for both your original and amended returns. Check the appropriate box based on whether you are single, married/RDP filing jointly, married/RDP filing separately, head of household, or qualifying widow(er).

- Complete the sections with financial details such as wages, federal adjusted gross income, California adjustments, and calculate your taxable income.

- Provide tax amounts, any exemptions, and any other relevant financial information as outlined in the form.

- Explain changes on Side 2 of the form. This includes detailing what adjustments were made and why, as well as attaching any supporting documents.

- Review all sections for accuracy and completeness, ensuring all required signatures are present.

- Once completed, you can save changes, download, print, or share the filled form as required.

Complete your CA FTB 540X form online now to ensure timely processing.

You are single and your total income is less than or equal to $17,252. You are married/RDP filing jointly or a qualifying surviving spouse/RDP and your total income is less than or equal to $34,554. You are head of household and your total income is less than or equal to $24,454.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.