Loading

Get Ca Form 587 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 587 online

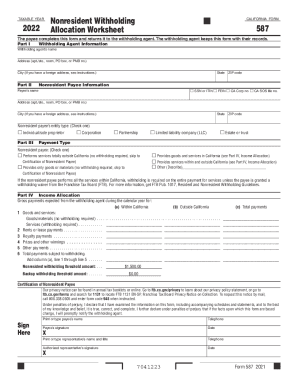

Completing the CA Form 587 online is essential for nonresidents participating in California transactions. This guide provides clear, step-by-step instructions to help you accurately fill out this important withholding allocation worksheet.

Follow the steps to successfully complete the CA Form 587 online.

- Click ‘Get Form’ button to access the CA Form 587 and open it in the designated online platform.

- In Part I, enter the withholding agent's name and address, including city and ZIP code. If you have a foreign address, follow the specific instructions provided.

- In Part II, provide the nonresident payee information. Select either SSN, ITIN, FEIN, CA Corp number, or CA SOS file number. Fill in the payee's name and address, including city and ZIP code.

- Indicate the entity type of the nonresident payee by checking one of the options: individual/sole proprietor, corporation, partnership, limited liability company (LLC), or estate/trust.

- For payment type, select the appropriate option that describes the nonresident payee's services, whether they are performed totally outside California, if goods or materials are provided, or if services are provided within and outside California. Additional details may be required.

- In Part IV, provide the income allocation by indicating the gross payments expected from the withholding agent for both services and goods, with specific columns for payments within and outside California.

- Complete the total payments and check the nonresident withholding threshold amount and backup withholding threshold amount to ensure compliance.

- In the Certification of Nonresident Payee section, sign and print or type the payee's name, provide a signature date, and if applicable, include details for an authorized representative.

- Finally, review all entered information for accuracy, and then save your changes, download, print, or share the form as needed.

Complete your CA Form 587 online today to ensure compliance with California tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A withholding agent is required to withhold from all payments or distributions of California source income made to a nonresident payee unless the withholding agent receives a certified Form 590, Withholding Exemption Certificate, or authorization from us for a waiver, or an approved reduced withholding amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.