Loading

Get Al Dor Form A-1 1998

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL DoR Form A-1 online

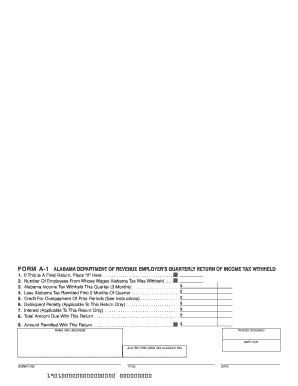

Completing the AL DoR Form A-1 is an essential task for employers in Alabama who need to report income tax withheld from their employees. This guide will provide you with clear, step-by-step instructions to fill out the form online efficiently and accurately.

Follow the steps to complete the form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Indicate if this is a final return by placing an 'X' in the designated box. This step is crucial if you are no longer required to submit returns.

- Input the number of employees from whom Alabama tax was withheld in the provided field.

- Enter the total amount of Alabama income tax withheld for the quarter in the respective section. Ensure that this figure reflects the total for all employees.

- In the following field, record the lesser amount of Alabama tax that was remitted during the first two months of the quarter.

- If applicable, include any credit for overpayment from prior periods as directed in the instructions.

- Add any delinquent penalty that is relevant to this return only, ensuring accuracy in this detail.

- Calculate and input any applicable interest for this return only.

- Sum all amounts to determine the total amount due with this return and record it in the designated box.

- Indicate the amount you are remitting with this return in the corresponding field.

- Complete the name and address section, filling in your business's details accurately.

- Specify the period covered by this return and the date it is due.

- Input your Alabama withholding tax account number as required.

- Sign the form, adding your title and the date of completion to validate the submission.

- Once all fields are filled out, save your changes, download a copy for your records, and print or share the form as necessary.

Begin completing your AL DoR Form A-1 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateState5.00%4.09%Local0.00%0.00%Total Income Taxes24.17%Income After Taxes4 more rows • Jan 1, 2023

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.