Loading

Get Oh Property Description Approval Form - Lucas County 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Property Description Approval Form - Lucas County online

This guide provides comprehensive and user-friendly instructions on how to accurately complete the OH Property Description Approval Form for Lucas County. Whether you are familiar with legal documentation or encountering this process for the first time, the following steps will help you navigate the online submission with confidence.

Follow the steps to successfully complete the OH Property Description Approval Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

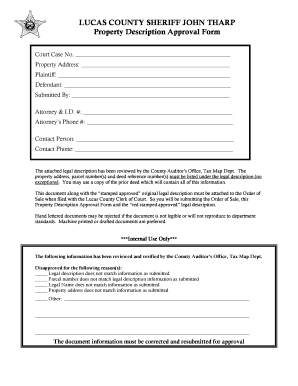

- Begin by entering the court case number in the designated field. This number is critical for tracking and processing your submission.

- Input the property address in the appropriate section. Ensure that it is complete and accurate to avoid delays.

- Fill in the names of the plaintiff and defendant in their respective fields. Make sure to enter the full legal names as they appear in the case documents.

- Complete the submitted by section with your name and the attorney's identification number below it. If you are representing yourself, input your own identification.

- Add the attorney’s phone number for any necessary follow-up regarding the submission.

- List the contact person and their phone number to ensure immediate communication if additional information is needed.

- Attach the legal description, ensuring it is reviewed and approved by the County Auditor’s Office. Confirm that the property address, parcel numbers, and deed reference numbers are listed correctly.

- When completing the form, remember that hand-lettered documents may be rejected. It is preferred to use machine-printed or drafted documents for clarity.

- Once all fields are filled out, save your changes, and prepare to download and print the form. Attach this form along with the 'stamped approved' original legal description before submitting everything to the Clerk of Court.

Take action now to complete and submit your documents online.

Related links form

The Deed Transfer Department transfers the owner's name and address on the real estate tax list and duplicate. The department also collects the transfer tax/ conveyance fee ($4.00 per $1,000 of sale price) and the transfer fee ($. 50 per parcel).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.