Loading

Get Ca Calpers Pers01m0051dmc 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CalPERS PERS01M0051DMC online

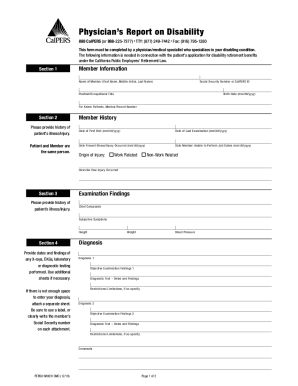

Filling out the CA CalPERS PERS01M0051DMC form is an essential step for individuals seeking disability retirement benefits. This guide will provide clear and comprehensive instructions on how to complete the form online, ensuring all necessary information is accurately included.

Follow the steps to complete the CA CalPERS PERS01M0051DMC form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Section 1, enter the member information. This includes the full name of the member, Social Security number or CalPERS ID, occupational title, birth date, and for Kaiser patients, the medical record number.

- For Section 2, provide a detailed history of the patient’s illness or injury. Include the dates of the first visit, last examination, and when the present illness or injury occurred. Make sure to specify if the origin of the injury is work-related or non-work-related and describe how the injury occurred.

- In Section 3, fill out the examination findings. This consists of recording chief complaints, subjective symptoms, height, weight, blood pressure, and diagnosis. Include detailed information regarding any diagnostic tests and findings.

- Continue in Section 4, where you document additional diagnoses, objective examination findings, and any restrictions or limitations. If more space is needed for diagnoses, attach a separate sheet clearly labeled with the member’s Social Security number.

- Move to Section 5 and confirm the member incapacity. Answer the questions on whether the member is substantially incapacitated, if the incapacity is permanent, and whether relevant documents were reviewed. Make sure to attach copies of the member’s medical records and maintaining diagnostic test reports.

- In Section 6, complete and sign the physician's section. Ensure to provide all requested information including your name, Social Security number or CalPERS ID, medical specialty, and mail the completed report directly to CalPERS.

- Upon completion, save any changes made to the document. You may also download, print, or share the completed form as needed to ensure timely submission.

Take the next step towards managing disability claims by completing the CA CalPERS PERS01M0051DMC form online today.

Related links form

Service retirement is a lifetime benefit. In most cases, the employee can retire as early as age 50 with five years of service credit. If the employee became a member on or after January 1, 2013, they must be at least 52 years old to retire.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.