Loading

Get Walden University Overlapping Financial Aid Form 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Walden University Overlapping Financial Aid Form online

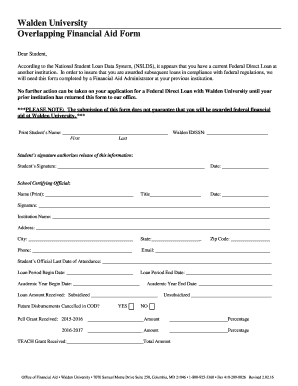

Completing the Walden University Overlapping Financial Aid Form is a vital step for students ensuring compliance with federal regulations regarding financial aid loans. This guide offers a clear, step-by-step approach to help you fill out the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Print the student’s name clearly in the designated field. This should include both the first and last names.

- Enter the Walden University ID or Social Security Number (SSN) in the appropriate section.

- The student must provide their signature to authorize the release of information, ensuring that all details are correct before signing.

- Record the date of signing the form to maintain an accurate timeline for the application process.

- Fill in the name, title, and date for the School Certifying Official at the previous institution, ensuring that all entries are legible.

- The School Certifying Official must provide their signature, institutional name, address, city, state, phone, and email to validate the form.

- Indicate the student’s official last date of attendance at the previous institution.

- Fill in the loan period begin and end dates, ensuring these dates reflect the correct periods related to financial aid.

- Complete the academic year begin and end dates accordingly.

- Document the loan amount received, specifying whether it is subsidized or unsubsidized.

- Indicate if future disbursements have been cancelled in the Common Origination and Disbursement (COD) system with a simple 'Yes' or 'No.'

- If applicable, record any Pell Grant amounts received during the specified academic years, noting both the amount and the percentage.

- If the TEACH Grant was received, record the total amount in the designated field.

- Review all entries for accuracy, then proceed to save your changes, download a copy, print, or share the form as required.

Complete your forms online today to ensure a smooth financial aid process.

Related links form

Yes, you will qualify for federal, state, and institutional financial aid until you have met all requirements for your first major. After that, only courses required for your second major can be considered for federal loans and work-study.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.