Loading

Get Canada Form 74.15 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Form 74.15 online

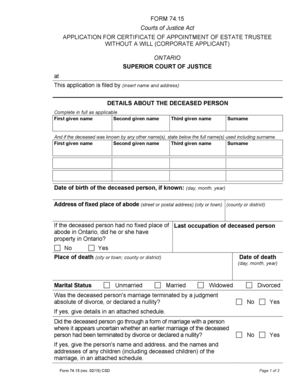

Filling out the Canada Form 74.15 is an important process for those seeking to apply for a certificate of appointment of estate trustee without a will. This guide will provide clear, step-by-step instructions tailored to users with varying levels of experience.

Follow the steps to complete the form accurately and efficiently

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide the name and address of the applicant who is filling out the form. Ensure that all information is accurate and complete.

- Next, fill out the details about the deceased person. Include their first, second, and third given names along with the surname. If applicable, note any other names the deceased was known by.

- Enter the date of birth of the deceased person, if known, and include their fixed address. If they had no fixed residence in Ontario, indicate whether they owned any property there.

- Complete the section regarding the marital status of the deceased. Choose the appropriate option and provide details regarding any previous marriages, including if they were terminated by divorce.

- List the persons entitled to share in the estate. For each person, record their name, address, relationship to the deceased, and age if they are under 18. Attach a schedule if more space is needed.

- In the section for the value of assets of the estate, do not include certain items as specified. Enter the value of personal property and real estate, and calculate the total value.

- Explain why the applicant has the right to apply for the estate certificate in the designated area, providing clear and concise reasoning.

- Complete the affidavit by providing the name and address of the corporate applicant, the name of the trust officer, and ensure the trust officer's signature is included. Follow any additional requirements as outlined.

- Review all entered information for accuracy. After confirming that all sections have been completed, save the changes. You can then download, print, or share the form as needed.

Start filling out your Canada Form 74.15 online now to ensure all details are accurately captured.

Related links form

When a person dies without a will someone, usually a close relative must apply to the court to be appointed as the estate trustee without a will. If there is a dispute as to who should be appointed the matter must be referred to a judge to determine the most appropriate person to act as estate trustee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.