Loading

Get Irs Ct-2 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS CT-2 online

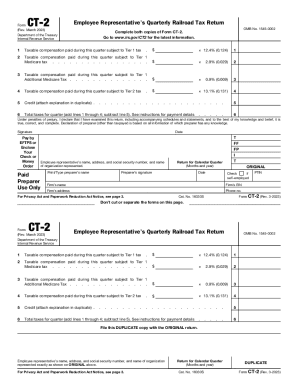

Filling out the IRS CT-2, Employee Representative’s Quarterly Railroad Tax Return, is essential for reporting railroad retirement taxes. This guide provides clear, user-friendly steps to help you successfully complete the form online.

Follow the steps to fill out the IRS CT-2 online.

- Click the ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Begin by entering your name, address, and social security number on the form. Ensure that this information matches exactly with the records of the organization you represent.

- Indicate the months covered by the return and the year for which you are filing. Use the formats specified in the instructions to avoid confusion.

- In line 1, enter the total taxable compensation paid during the quarter that is subject to Tier 1 tax. Multiply this amount by 12.4% (0.124) to calculate the Tier 1 tax owed.

- For line 2, enter the taxable compensation subjected to Tier 1 Medicare tax. Multiply this by 2.9% (0.029).

- If applicable, complete line 3 for the Tier 1 Additional Medicare Tax. This tax applies to compensation exceeding $200,000. Multiply the appropriate amount by 0.9% (0.009).

- Proceed to line 4 and enter the taxable compensation paid that falls under Tier 2 tax. Multiply this by 13.1% (0.131).

- If you have any credits to report, enter them on line 5 and attach the necessary explanation in duplicate.

- Calculate the total taxes for the quarter by summing lines 1 through 4 and subtracting line 5. Enter the result on line 6.

- Review your entries carefully. Once confirmed, save your changes, then download or print the form to keep a record for your files.

Complete your IRS CT-2 form online to ensure accurate reporting of your railroad taxes.

Related links form

There's no single IRS address. The one you use depends on where you're filing from and whether your return includes a payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.