Loading

Get Dm Ird Vat-001 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DM IRD VAT-001 online

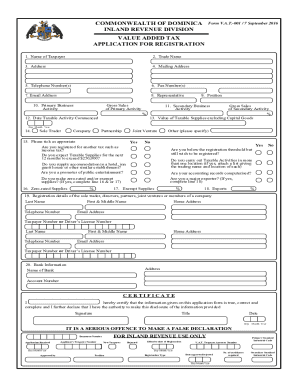

Completing the DM IRD VAT-001 form online is an essential step for taxpayers in the Commonwealth of Dominica seeking to register for value added tax. This guide provides a structured approach to help you navigate each section of the form with confidence and accuracy.

Follow the steps to accurately complete the DM IRD VAT-001 form.

- Click ‘Get Form’ button to access the VAT-001 form.

- Enter the name of the taxpayer in the designated field, ensuring that the spelling is correct and complete.

- Provide the trade name if applicable; this is the name under which the business operates.

- Fill in the address of the business–this should be the physical location of your operations.

- Complete the mailing address if it differs from your physical address.

- Input a valid telephone number and any additional numbers for contact.

- Include a fax number if available; otherwise, you may leave it blank.

- Provide an email address that you regularly check for important communications regarding your application.

- Indicate the representative's details if someone is filling out the form on your behalf, including their position.

- Describe your primary business activity clearly and accurately.

- Indicate the date when your taxable activity commenced, using the format Day/Month/Year.

- Detail your secondary business activity and corresponding gross sales if applicable.

- Indicate your business structure by selecting one option: Sole Trader, Company, Partnership, or Joint Venture.

- Answer the questions regarding other tax registrations and future taxable supplies, providing explanations where necessary.

- If applicable, provide the percentage of your zero-rated supplies.

- Indicate the percentage of any exempt supplies.

- Detail the percentage of your exports as required.

- Complete the section regarding the registration details of individuals associated with the business.

- Fill in your bank information, including the bank's name and account number.

- Certify the accuracy of your information by providing your title, signature, and the date on which you completed the form.

- Review all provided information for accuracy before finalizing your application.

- Save changes, download, print, or share the form as required.

Start completing your DM IRD VAT-001 form online today for smooth registration.

VAT is charged on things like: goods and services (a service is anything other than supplying goods) hiring or loaning goods to someone. selling business assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.