Loading

Get Hk Ir56m 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HK IR56M online

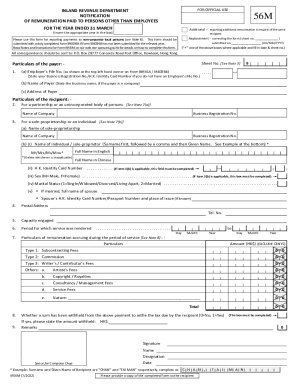

The HK IR56M form is essential for reporting remuneration paid to non-corporate local persons. This guide provides clear and concise instructions on how to complete the form online, ensuring users can navigate the process with confidence and ease.

Follow the steps to accurately complete the HK IR56M form

- Press the ‘Get Form’ button to obtain the HK IR56M form and access it in the online editor.

- Once the form is open, begin by entering the appropriate year in the designated box at the top.

- Indicate the purpose of the form by selecting one of the options: ‘Additional’ for reporting more remuneration for the same recipient, or ‘Replacement’ if correcting a previously submitted form. Fill in the sheet number and submission date if applicable.

- Complete the particulars of the payer section, which includes the employer’s file number, name, and address of the payer.

- Fill in the particulars of the recipient. For partnerships or unincorporated bodies, provide the company name and registration number. For individual sole proprietors, include the individual's name, identity card number, and additional details as required.

- Specify the postal address and telephone number of the recipient.

- Indicate the capacity in which the recipient was engaged and the period during which services were rendered.

- In the remuneration section, fill out the details of payments made during the service period, including the amounts for subcontracting fees, commissions, and any other applicable types of remuneration.

- Indicate if any amount was withheld from the payment to cover tax due by the recipient. If so, state the amount withheld.

- Review all the details for accuracy, then provide your signature, name, designation, and the date of completion. Include the company chop if necessary.

- Finally, save your changes, download a copy, print the form, or share it as needed.

Complete your HK IR56M form online today for a smooth filing experience.

Related links form

Failure to file the Annual Returns within a prescribed time period will result in a maximum penalty of HK$50,000 for each breach. There is also a daily default fine of HK$1,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.