Loading

Get Uk Iht35 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IHT35 online

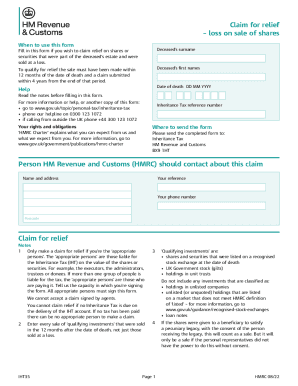

This guide provides a clear and supportive overview on how to fill out the UK Inheritance Tax form IHT35 online. Claim relief for shares or securities sold at a loss after the death of an individual by following these detailed steps.

Follow the steps to complete the UK IHT35 form online effectively.

- Press the ‘Get Form’ button to acquire the UK IHT35 form and open it in the editor.

- Begin by entering the deceased's surname and first names in the specified fields. Ensure these are accurately filled out.

- Input the date of death in the format DD MM YYYY, as this information is crucial for establishing eligibility for relief.

- Fill in the Inheritance Tax reference number, which is necessary for tracking your claim.

- List all qualifying investments sold in the 12 months following the date of death. Record details including the full description of each holding as well as their sale prices.

- If there were any purchases of qualifying investments between the date of death and two months after the last sale, indicate this by answering the respective question and providing details.

- Complete the repayment authority by entering the account name, sort code, and account number where any overpaid Inheritance Tax should be repaid.

- Finalize your entry by signing and dating the form as the appropriate person, thereby confirming that all information provided is true and complete.

- Once all information is complete, save your changes, download, print, or share the completed IHT35 form as needed.

Complete your Inheritance Tax relief claim online using this guide for a streamlined experience.

To encourage more people to leave donations to charity in their will, any gifts to a qualifying charitable body are exempt from IHT. This also applies if they are gifts made during your lifetime.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.