Loading

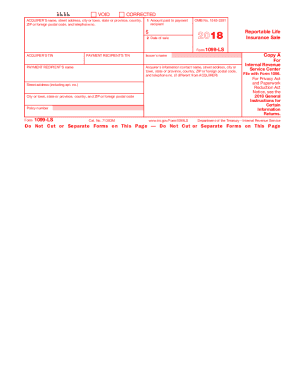

Get Irs 1099-ls 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-LS online

The IRS 1099-LS form is utilized for reporting reportable life insurance sales. This guide provides a clear and supportive step-by-step approach to filling out the form online, ensuring that users can complete it accurately and efficiently.

Follow the steps to fill out the IRS 1099-LS online.

- Click ‘Get Form’ button to obtain the 1099-LS form and open it in your preferred online editing tool.

- In the section for the acquirer, enter the name and contact information, including the street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number. Ensure that this information is accurate, as it will identify the party making the report.

- Fill in the acquirer's Taxpayer Identification Number (TIN). This is important for accurate reporting and must match the IRS records.

- In the payment recipient section, input the recipient's name and their TIN. Similar to the acquirer, confirming this information is vital for correct reporting.

- Complete the fields for the policy number associated with the reportable life insurance sale. This helps in maintaining clarity regarding which contract is being referred to.

- Indicate the amount paid to the payment recipient in the designated box. It is essential to input the exact amount disbursed to ensure proper tax reporting.

- Record the date of the sale accurately, as it is crucial for establishing the timeline of the transaction.

- Lastly, review all the entered data for accuracy. Once verified, save the changes to your form. You may also print, download, or share the completed form as needed.

Start filling out your IRS 1099-LS form online today to ensure timely and accurate reporting.

Related links form

The term ''reportable death benefits'' means amounts paid by reason of the death of the in- sured under a life insurance contract that has been transferred in a reportable policy sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.