Loading

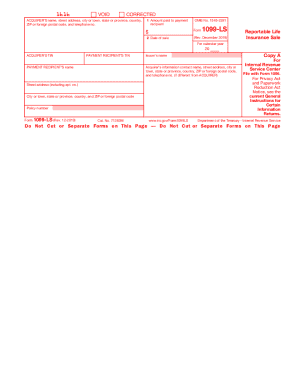

Get Irs 1099-ls 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-LS online

This guide provides clear and detailed instructions for users looking to fill out the IRS 1099-LS form online. By following these steps, you can ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the IRS 1099-LS correctly.

- Click ‘Get Form’ button to access the IRS 1099-LS form online and open it in the editor.

- Enter the acquirer’s name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the respective fields.

- Input the amount paid to the payment recipient in Box 1. This represents the total payment made during the reportable life insurance sale.

- Fill in the date of the sale in Box 2. Ensure that the date reflects when the transaction occurred.

- Provide the acquirer’s taxpayer identification number (TIN) and the payment recipient’s TIN. This information is crucial for tax reporting purposes.

- Include the payment recipient’s name in the designated field to correctly identify the individual or entity receiving the payment.

- If necessary, add any additional contact information for the acquirer, especially if different from the previously entered details.

- Review all the provided information for accuracy to avoid penalties. Ensure that all required fields are completed.

- Once you have filled out the form, save the changes, and choose to download, print, or share the completed IRS 1099-LS as needed.

Begin filling out the IRS 1099-LS form online to ensure your compliance and accurate reporting.

Related links form

If the business or other party involved in the real estate transaction submits a 1099-S form to the IRS, as they are required to do by law, and a taxpayer does not report it, the IRS will likely send a bill for taxes owed on the income. Taxpayers do not have to include 1099s with their tax returns submitted to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.