Loading

Get Oh Odt It 2023 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH ODT IT 2023 online

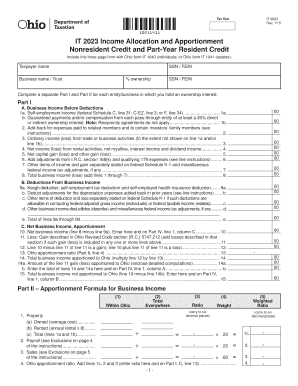

The OH ODT IT 2023 form is essential for nonresidents and part-year residents to report income allocation and apportionment in Ohio. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the OH ODT IT 2023 form online.

- Press the ‘Get Form’ button to access the OH ODT IT 2023 document and open it in your preferred editor.

- Begin by entering your taxpayer name and SSN or FEIN at the top of the form. If applicable, input the business name or trust and indicate the percentage of ownership.

- Complete a separate Part I and Part II for each entity or business where you hold an ownership interest, following the outlined sections closely.

- In Part I, section A, report all relevant business income before deductions including self-employment income, guaranteed payments, and ordinary income. Add all figures for total business income.

- In section B of Part I, denote any applicable deductions from business income, including Keogh deductions and self-employed health insurance deductions. Calculate the total for this section.

- Calculate the net business income in section C by subtracting the total deductions from your total business income. Ensure you also follow the steps for Ohio apportionment ratio based on property, payroll, and sales.

- Proceed to Part II if necessary, where you will use the provided formulas to determine your Ohio apportionment ratio using the income and expenses from your business activities.

- In Part III, allocate any nonbusiness income and deductions. Be careful to differentiate between business-related and nonbusiness-related income as outlined by the instructions.

- Finally, summarize your findings in Part IV, detailing both business and nonbusiness income. Ensure all entries are accurately calculated and noted.

- Once you have completed all sections, save your changes, download a copy of the form, and print it if necessary for your records or filing purposes.

Complete your OH ODT IT 2023 form securely and conveniently online today.

Related links form

Personal income tax bracket reduction 2023 Brackets2023 Tax Rate2024 Tax Rate$0 - $26,0500%0%Over $26,050 - $100,0002.75%2.75%Over $100,000 - $115,3003.688%3.688%Over $115,3003.75% Jul 13, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.