Loading

Get Md Ccar 2001 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD CCAR 2001 online

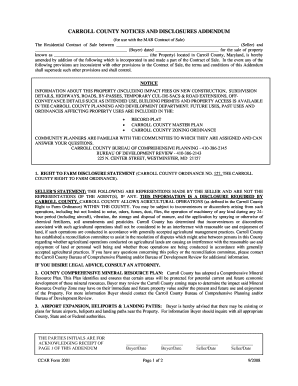

This guide provides step-by-step instructions for filling out the MD CCAR 2001 form, which pertains to the Carroll County Notices and Disclosures Addendum. Whether you are a seller or a buyer, this comprehensive guide will help you understand each section of the form and how to complete it online effectively.

Follow the steps to complete the MD CCAR 2001 form online.

- Press the ‘Get Form’ button to obtain the MD CCAR 2001 form and open it for editing.

- Begin by filling out the top section of the form with the names of the seller and buyer, ensuring all information is accurate and complete.

- Enter the date of the Residential Contract of Sale in the designated field where it states 'dated'.

- Next, specify the property address where indicated. This should include the full legal description of the property in Carroll County.

- Proceed to the notices section, reviewing and checking the applicable items for the buyer's awareness and understanding of property-related issues like agricultural operations, deferred water and sewer charges, and existing landfill sites.

- Both the seller and buyer must acknowledge and initial each section of the form where indicated to confirm receipt and understanding of the disclosures.

- Finally, once all sections are completed, signatures and dates should be entered for both parties at the end of the document. Ensure all information is verified before proceeding.

- After finalizing all entries, you can save changes, download, or print the form according to your requirements.

Complete your digital documentation by filing the MD CCAR 2001 online today.

Unfortunately, the Maryland estate tax exemption is not portable like in some other states. This means that if one spouse does not use their exemption, the other spouse cannot claim it. Being aware of the intricacies of MD CCAR 2001 is essential for effective estate planning to maximize exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.