Loading

Get Ky A-1 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY A-1 online

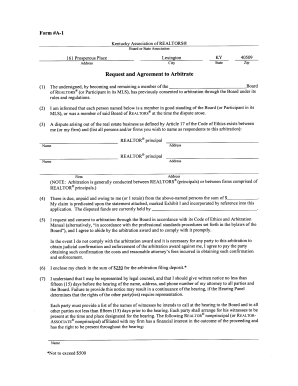

Filling out the KY A-1 form is a crucial step for individuals seeking arbitration through the Kentucky Association of REALTORS®. This guide will provide you with clear, step-by-step instructions to successfully complete the form online, ensuring you meet all necessary requirements.

Follow the steps to fill out the KY A-1 form online effectively.

- Press the ‘Get Form’ button to obtain the KY A-1 form and open it in your online editor.

- Begin by entering your address details where indicated, including street address, city, state (KY), and zip code (40509).

- In section (1), confirm your membership by providing your name and indicating that you are a member of the Board of REALTORS® or a participant in its MLS.

- In section (3), list all parties involved in the dispute, including their names and addresses.

- In section (4), indicate the amount that is due to you from the listed parties.

- In section (5), confirm your request for arbitration and state your agreement to abide by the arbitration award.

- In section (6), enclose a check for the arbitration filing deposit of $250 throughout the online process.

- Section (7) allows you to provide information about your legal representative, if applicable, including contact details.

- In section (9), declare the accuracy of the information provided and ensure it is submitted within the required time frame.

- Finally, review all sections of the form for accuracy. Save your changes, download, print, or share the completed form as required.

Complete your KY A-1 form online today to facilitate your arbitration process.

A beneficiary Schedule K-1 reports the share of income, deductions, and credits that a beneficiary receives from an estate or trust. This form is crucial for beneficiaries when filing their individual tax returns. Understanding how to read and utilize the Schedule K-1 can simplify your tax process, particularly when dealing with KY A-1 requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.