Loading

Get Jm It05 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JM IT05 online

Filling out the JM IT05 form is an essential task for individuals reporting their income and tax payable in Jamaica. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the JM IT05 form seamlessly.

- Press the ‘Get Form’ button to access and open the JM IT05 form in your preferred online editor.

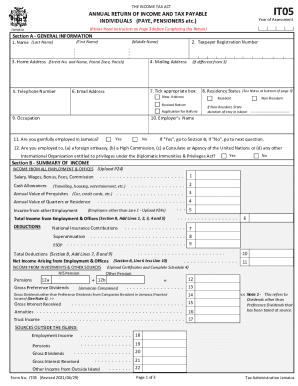

- Begin by completing Section A – General Information. Enter your full name, Taxpayer Registration Number, home address, mailing address, contact number, and email address. Ensure that you provide accurate and up-to-date information.

- Tick the appropriate box for residency status and indicate if this is a revised return or an application for a refund. If you're a non-resident, specify your duration of stay in Jamaica.

- Provide details about your employer's name and occupation in Section A. Indicate whether you are gainfully employed in Jamaica and answer additional questions regarding employment with foreign organizations.

- Move to Section B – Summary of Income. Here, list all income from employment, other sources, and complete related income sections as specified, using P24 documents as needed.

- Add deductions such as National Insurance Contributions and superannuation. Calculate your total deductions and determine your net income from employment.

- Continue filling in income details from investments and other sources, ensuring to upload relevant certificates as required.

- In Section C, report any exemptions and franked income. Calculate total exemptions and complete the subsequent lines as directed.

- Proceed to Section D for deductions and statutory income calculations, following any specified instructions carefully.

- Complete Section E, which involves computing your income tax payable and entering any non-refundable tax credits.

- If applicable, fill out Section F for the computation of education tax payable, ensuring to restrict to zero where instructed.

- Finally, sign Section H – Declaration to confirm the accuracy of your returned information, and then save your changes.

- You can now download, print, or share the completed JM IT05 form as needed.

Complete your JM IT05 form online today and ensure your tax obligations are fulfilled correctly.

Employees are encouraged to request a P45 from their employers when they are laid off. For further information persons may call the TAJ Customer Care Centre at 888-Tax-Help (888-829-4357).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.