Loading

Get Fl Dr-535 1992-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-535 online

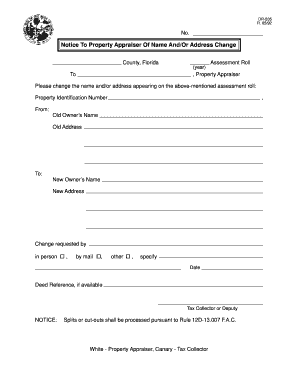

The FL DR-535 form is used to notify the property appraiser of any changes to your name or address as it appears on the assessment roll in Florida. Filling out this document accurately is essential for maintaining up-to-date records with local authorities.

Follow the steps to complete the FL DR-535 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the provided fields, enter the property identification number associated with your property. This number helps the property appraiser locate your assessment on the roll.

- Fill in the 'From' section with the old owner's name and address that you wish to update. Ensure that you enter complete and accurate information to avoid processing issues.

- In the 'To' section, provide the new owner's name and address. Double-check for any typos to ensure the change is correctly recorded.

- Indicate the method of change request by selecting one of the options: 'in person,' 'by mail,' or 'other.' If you select 'other,' specify the means you are using to submit the request.

- Enter the date of the request to document when the change was initiated. This is important for record-keeping.

- If applicable, include the deed reference in the designated field. This information can help validate the ownership change.

- Finally, save your changes, and you can choose to download, print, or share the completed form as necessary.

Take action now and complete your FL DR-535 form online to ensure your property records are up to date.

To speak to someone at the Department of Revenue in Florida, simply call their main number at 1-850-488-6800. Ensure you have your questions ready, particularly if they pertain to the FL DR-535, so you can receive the best assistance possible. Their representatives are there to help you navigate any tax issues you may have.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.