Loading

Get Pa Bco-10 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA BCO-10 online

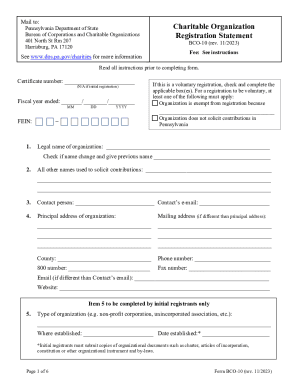

The PA BCO-10 is a registration statement for charitable organizations in Pennsylvania. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that users can accurately provide the necessary information.

Follow the steps to complete the PA BCO-10 online:

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the certificate number if applicable; leave it blank for initial registration.

- Fill in the fiscal year ending date in MM/DD/YYYY format.

- Provide your organization’s Federal Employer Identification Number (FEIN).

- If this is a voluntary registration, check the applicable box and provide the required details.

- Input the legal name of the organization and indicate if there has been a name change.

- List all names used to solicit contributions.

- Identify a contact person and provide their email address.

- Complete the principal address of the organization and any mailing address if different.

- Fill in the county and provide contact phone numbers, including an 800 number, if applicable.

- Indicate the organization's type (e.g., non-profit corporation) and its establishment date.

- List the names and addresses of any subsidiary units in Pennsylvania.

- Indicate applicability for short form registration and select the appropriate section.

- Provide the date of first solicitation from Pennsylvania residents.

- Indicate whether gross contributions exceeding $25,000 were received.

- Specify if the organization has IRS tax-exempt status and provide details as necessary.

- Detail the type of IRS 990 return filed for the most recent fiscal year.

- Describe how contributions are solicited.

- Explain the specific programs funded by contributions.

- Declare whether the organization is registered in other states.

- Indicate whether any compensated persons solicit contributions in Pennsylvania.

- Provide details about any professional solicitors and their contracts.

- List necessary officers and staff involved in solicitation and financial oversight.

- Confirm whether any relationships exist among officers that require disclosure.

- Respond to questions about prior legal issues or denials in registration.

- Ensure the certification section is signed and dated by the chief fiscal officer and another authorized officer.

- Compile necessary attachments such as IRS returns, financial statements, and the registration fee.

- Once all information is reviewed and complete, save changes, download, print, or share the form.

Start your registration process by filling out the PA BCO-10 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Through the Bureau of Corporations and Charitable Organizations (BCCO), the department assists Pennsylvania business owners and entrepreneurs with starting, sustaining and expanding their companies.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.