Loading

Get Tn Rv-f1321001 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1321001 online

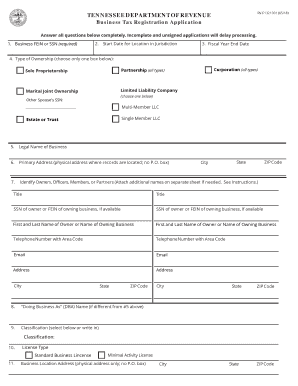

The TN RV-F1321001 form, also known as the Business Tax Registration Application, is essential for registering your business for tax purposes in Tennessee. This guide provides clear instructions to assist you in completing this form online accurately.

Follow the steps to fill out the Business Tax Registration Application effectively.

- Press the ‘Get Form’ button to access the application form and open it in your preferred editor.

- Enter your business federal employer identification number (FEIN) or the owner’s social security number (SSN). This information is mandatory.

- Provide the start date for your business's location in the jurisdiction.

- Indicate the fiscal year-end date, which is crucial for federal tax purposes.

- Select the type of ownership from the options provided, ensuring to choose only one.

- Input the legal name of your business as registered with federal tax authorities.

- Fill in the primary address where your business records are maintained (please note, a P.O. box is not acceptable).

- Identify owners, officers, members, or partners associated with the business, attaching additional names on a separate sheet if necessary.

- If applicable, include the 'doing business as' (DBA) name that differs from the legal name.

- Select the appropriate classification for your business tax.

- Choose the license type between standard business license and minimal activity license.

- Clearly describe the principal business activity conducted at the stated location.

- Provide a mailing address for the business, which can include a P.O. box.

- Enter business contact details, including telephone and email information.

- Ensure that the application is signed by at least one owner, officer, member, or partner, with their date of signature included.

- Lastly, save your changes, then download, print, or share the completed form as needed.

Complete your TN RV-F1321001 online today for efficient business registration!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.