Loading

Get Crummey Trust Agreement For Benefit Of Child With Parents As Trustors 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crummey Trust Agreement for Benefit of Child with Parents as Trustors online

Creating a Crummey Trust Agreement is an essential step for parents looking to secure their child's financial future. This guide provides a clear and supportive walkthrough for filling out this important document online.

Follow the steps to successfully complete your Crummey Trust Agreement online.

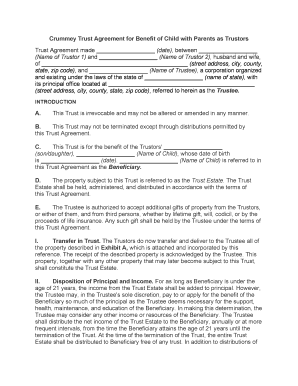

- Click the ‘Get Form’ button to obtain the Crummey Trust Agreement and open it in your chosen application for editing.

- Enter the date of the agreement in the designated field. This marks the official start date of the trust.

- Fill in the names of the Trustors. Include both parents’ full names where indicated.

- Complete the Trustors' address details. Fill in the street address, city, county, state, and zip code.

- Specify the name of the Trustee, which may be an individual or a corporation, along with the necessary address details.

- Identify the beneficiary by entering their name and date of birth. This information is crucial as it indicates who will benefit from the trust.

- Review the section outlining the Trust Estate. This is where you'll acknowledge the property that will be included in the trust.

- Fill in the necessary fields regarding the distributions of principal and income until the beneficiary reaches a specified age.

- Indicate the numbers and percentages for distribution as the beneficiary reaches designated ages, ensuring accurate representation.

- Complete additional provisions regarding withdrawal rights and any limits on withdrawals that you wish to implement.

- Fill in other provisions, including the death of the beneficiary, powers of the trustee, and any successor trustees if applicable.

- Ensure to detail the required legal language for taxes, distributions, and termination of the trust where prompted.

- Sign the document where indicated, ensuring all Trustors and the Trustee provide the necessary signatures.

- After completing all fields, review the document for accuracy and completeness before finalizing.

- Save your changes, and choose the option to download, print, or share the completed Crummey Trust Agreement.

Begin filling out your Crummey Trust Agreement online today to secure your child's future.

Prior to the beneficiary's turning age 21, income retained by the trust is taxed to the trust. Because the trust is a separate taxpayer, separate income tax returns for the trust must be filed each year. Any income distributed to the beneficiary will be taxed to the beneficiary, subject to the kiddie tax rules.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.