Loading

Get Implementing The New Sba : Streamlining Loan Servicing - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Implementing the new SBA: Streamlining loan servicing - SBA online

Filling out the Implementing the new SBA: Streamlining loan servicing - SBA form can seem overwhelming, but this guide will help you navigate it with ease. By understanding each section and field, you will ensure that your submission is thorough and accurate.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section carefully. This section outlines the purpose of the form and what to expect as you fill it out.

- Complete the personal information section. Provide your name, contact details, and any relevant identification numbers as required.

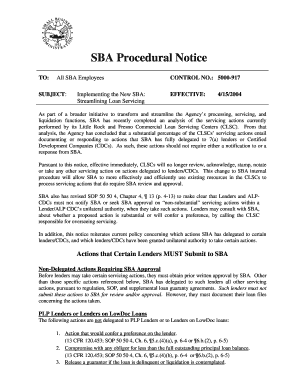

- Next, focus on the loan servicing actions section: identify and indicate the specific loan actions you are taking. Follow the guidelines provided to determine if a notification or approval is required.

- Refer to the list of delegated and non-delegated actions to clarify your responsibilities and obligations regarding servicing actions.

- Review the actions that require SBA notification. Document any actions from this list, as you will need to inform the CLSC about them.

- Once all relevant sections are completed, review your entries for accuracy. Make sure that all required information is filled in correctly.

- Finally, save your changes. You can choose to download, print, or share the form as needed based on your workflow.

Get started today and complete your documents online for a smoother process!

In the case of a loan modification, the business owner intends to pay 100% of the amount owed, plus interest. He is merely seeking longer amortizations, balloon payments due at the maturity of the loan or a reduction in the interest—all with the goal of reducing the monthly debt service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.