Loading

Get U. S. Small Business Administration Fact Sheet - Sba - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the U. S. SMALL BUSINESS ADMINISTRATION FACT SHEET - SBA - Sba online

This guide provides clear, step-by-step instructions for completing the U. S. Small Business Administration Fact Sheet. Whether you are seeking financial assistance after a disaster or needing information about the loans offered, this guide helps you navigate the form efficiently and effectively.

Follow the steps to fill out the fact sheet reliably and accurately.

- Press the ‘Get Form’ button to access the form and open it in your editor.

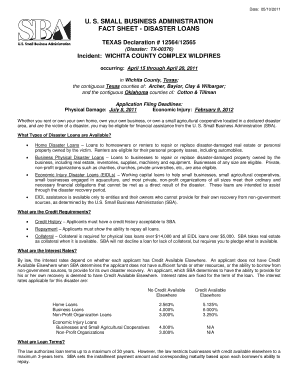

- Review the introduction section of the form thoroughly to understand its purpose and the types of disaster loans available, including Home Disaster Loans, Business Physical Disaster Loans, and Economic Injury Disaster Loans (EIDLs).

- Fill in your personal information in the designated fields, ensuring your name, contact details, and business information are accurate.

- Provide detailed information regarding the disaster that affected you, including the date of the incident and the nature of the damages suffered.

- Complete the sections related to loan eligibility, specifying any uninsured losses and clarifying how they relate to your current situation.

- Indicate any credit history and repayment ability as required, ensuring to present reasonable assurance that you can manage the loan repayments.

- Check the fields for loan amount limits, specifying the financial figures related to the damages you've verified.

- Once you have filled out all necessary fields, review the form for accuracy and completeness to avoid any delays in processing your application.

- Choose your next action; you can save changes, download a copy, print the form, or share it as required.

Begin filling out your application online today to secure the assistance you need.

For SBA-ready books, you should have completed financials for the last five years of your business: a fully completed and accurate ledger of transactions, list of accounts, an income statement, and balance sheet. That will put you in the best possible position if the SBA chooses to audit your business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.