Loading

Get Instructions For Completing The Attached Irs Form ... - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INSTRUCTIONS FOR COMPLETING THE ATTACHED IRS FORM 8821 online

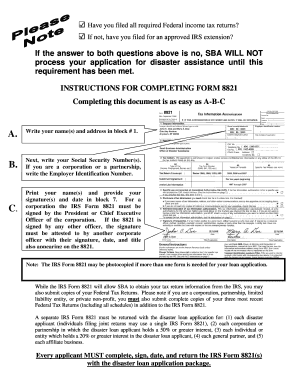

Filling out the IRS Form 8821 is a crucial step for individuals or entities applying for disaster assistance through the Small Business Administration. This guide provides clear, step-by-step instructions tailored for users with varying levels of experience in completing IRS forms.

Follow the steps to successfully complete the IRS Form 8821.

- Press the ‘Get Form’ button to access the IRS Form 8821 and open it in your preferred editing tool.

- In block #1, enter your name(s) and address. Make sure to fill this accurately to avoid any processing delays.

- Input your Social Security Number(s) in the designated field. If you are completing the form as a corporation or partnership, provide the Employer Identification Number instead.

- Proceed to block #7 to print your name(s) and add your signature(s) along with the date. For corporations, ensure that the form is signed by the President or Chief Executive Officer. If signed by another officer, that signature must be attested by another officer, including their signature, date, and title.

- If more than one form is required for your application, remember that the IRS Form 8821 can be photocopied.

- While completing this form allows the SBA to access your tax return information from the IRS, you may also attach copies of your Federal Tax Returns. Corporations, partnerships, limited liability entities, or private non-profits must provide complete copies of their three most recent Federal Tax Returns, including all schedules, in addition to the IRS Form 8821.

- Ensure that a separate IRS Form 8821 is included for each disaster applicant. This includes (1) each applicant, (2) each corporation or partnership with a 50% or greater interest, (3) each individual or entity with a 20% or greater interest in the applicant, (4) each general partner, and (5) each affiliate business.

- Finally, all applicants must complete, sign, date, and return the IRS Form 8821(s) along with their disaster loan application package.

Complete your forms online to streamline your disaster assistance application process.

Related links form

IRS Form 4506-C must be completed electronically and have a wet signature. The Air District will submit the Form 4506-C to the IRS on your behalf.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.