Loading

Get Disaster Business Loan Training For Lenders Qa. Pdf - Sba - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Disaster Business Loan Training For Lenders QA. PDF - SBA - Sba online

This guide provides comprehensive instructions on filling out the Disaster Business Loan Training For Lenders QA. PDF. It aims to support lenders in effectively managing disaster loan applications while ensuring clarity and ease of use for all users.

Follow the steps to successfully complete the form.

- To begin, click the ‘Get Form’ button to access the form and open it in your chosen document editor.

- Review the introductory sections of the document to familiarize yourself with the purpose of the training. Understanding the context will help you accurately respond to various sections and fields.

- Proceed to fill out any required personal information accurately. Ensure that you provide clear and correct information to facilitate processing.

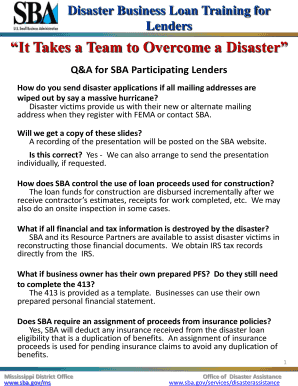

- Focus on the questions related to disaster application submissions. Ensure you understand the guidelines provided, particularly regarding mailing address changes and document reconstruction assistance.

- Address the sections concerning the management of loan proceeds, including the necessary inspections and documentation for construction loans. Make sure to note the incremental disbursement process.

- Carefully review the provisions regarding financial documentation. If any documents have been destroyed, check the available options for reconstruction, as mentioned in the Q&A.

- Complete any additional required forms, such as the personal financial statement, ensuring consistency with your uploaded documents where applicable.

- Check for any sections that detail the lender's role in assisting clients with the SBA disaster loan application process. Ensure you represent these responsibilities accurately.

- Finalize your document by reviewing each section for accuracy and completeness. Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Disaster Business Loan Training For Lenders QA. PDF online now for effective support in disaster loan management.

Related links form

Qualifications to become an SBA underwriter include a bachelor's degree in finance, business, or a similar field. Professional certifications are available and may be required by certain employers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.