Loading

Get Ma Chapter 7 Bankruptcy Questionnaire 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Chapter 7 Bankruptcy Questionnaire online

Filling out the MA Chapter 7 Bankruptcy Questionnaire online can seem daunting, but with the right guidance, you can complete it accurately. This comprehensive guide will walk you through each section of the form to ensure a smoother filing process.

Follow the steps to complete the questionnaire effectively.

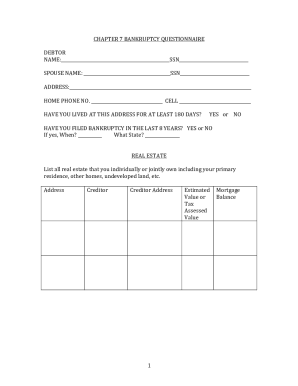

- Click the ‘Get Form’ button to obtain the MA Chapter 7 Bankruptcy Questionnaire and access it in your online document editor.

- Begin by entering your personal information in the designated fields marked for your full name, social security number, and date of birth. Ensure that you spell out your name correctly and provide accurate identification details.

- Input your current street address, city, state, zip code, and county of residence. If you have lived at this address for less than six months, indicate your length of time there.

- Provide contact numbers including your home and alternative phone numbers, as well as your email address for correspondence and notifications.

- If applicable, fill in the mailing address section with a different address where you want to receive correspondence, such as a post office box.

- Next, complete the section regarding information about your spouse. If applicable, provide their name, social security number, date of birth, and other relevant information.

- Indicate whether you reside together and if you have filed for bankruptcy in the last eight years. This section is crucial for understanding your financial history.

- List all dependents under your care, along with their ages and relationships to you, marking whether they live with you.

- Next, outline your income history, detailing your employers, addresses, job titles, duration at each job, and frequency of payment. Be thorough in listing your gross income over the last year and additional income sources.

- Proceed to detail any debts you have, ensuring you provide information about each creditor as required. This includes the name of the creditor, the amount owed, and any potential legal actions related to these debts.

- After completing all sections, carefully review the entire document to confirm accuracy. Once satisfied, save your changes, and utilize the options provided to download, print, or share the form as needed.

Take the next step towards financial relief by filling out your MA Chapter 7 Bankruptcy Questionnaire online today.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. However, if your disposable income is more than a certain sum, you will not be able to file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.