Loading

Get Lpl Financial Cm107-cdt 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LPL Financial CM107-CDT online

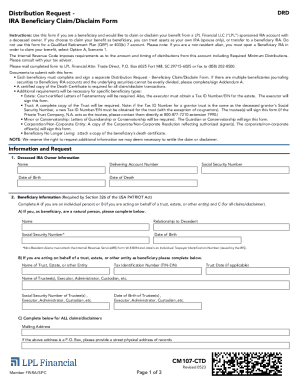

Filling out the LPL Financial CM107-CDT, also known as the Distribution Request IRA Beneficiary Claim/Disclaim Form, is essential for beneficiaries wishing to claim or disclaim benefits from a deceased owner's IRA account. This guide provides clear, step-by-step instructions to simplify the process for you.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the deceased IRA owner information including their name, delivering account number, date of birth, date of death, and social security number. Ensure all details are accurate.

- Complete section for beneficiary information. If you are an individual, fill out Part A; if claiming on behalf of a trust or estate, fill out Part B; and for all claims/disclaimers, complete section C including your mailing address.

- Choose and complete one of the beneficiary options (A, B, or C). Each option has specific instructions: Option A is for direct transfer; Option B is the spousal transfer; and Option C is for disclaimers.

- For Option A, fill in the transfer details, including the amount to be transferred and the beneficiary IRA account number. For Option B, indicate whether you treat the decedent IRA as your own and provide the necessary account number. For Option C, specify your disclaimer preferences.

- Sign the form to certify that you understand the tax implications and have received the necessary information from LPL Financial. Ensure you understand the responsibility for any tax implications that may arise.

- Review the completed form for accuracy before proceeding to submit it. You may save changes, download, print, or share the form as needed.

Complete your LPL Financial CM107-CDT form online for a smoother and more efficient process.

"Disclaim" the inherited retirement account Regardless of your relationship with the account holder, you can opt to disclaim, or not accept, the inheritance and pass on the assets to an alternate beneficiary, such as another family member.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.