Loading

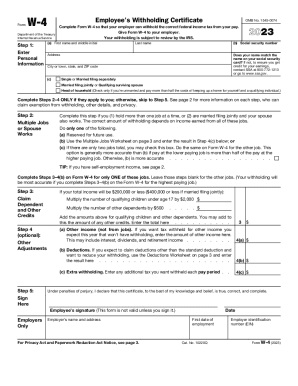

Get 2023 Form W-4. Employee's Withholding Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Exemption from withholding. You may claim exemption from withholding for 2023 if you meet both of the following conditions: you had no federal income tax liability in 2022 and you expect to have no federal income tax liability in 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.