Loading

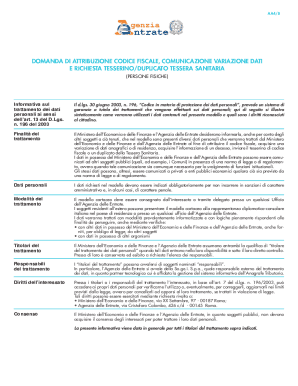

Get It Agenzia Entrate Domanda Di Attribuzione Codice Fiscale Comunicazione Variazione Dati - Persone 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT Agenzia Entrate Domanda Di Attribuzione Codice Fiscale Comunicazione Variazione Dati - Persone online

This guide provides users with a step-by-step approach to completing the IT Agenzia Entrate Domanda Di Attribuzione Codice Fiscale Comunicazione Variazione Dati - Persone form online. By following the instructions herein, you will effectively navigate each section of the form with ease and accuracy.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to acquire the form and open it in the designated editing interface.

- In Sezione I, select whether you are making a direct request for yourself or for a third party. Indicate this by checking the relevant option.

- Fill out the request section by indicating your purpose for submission. Choose one of the following options: 'Attribution of codice fiscale', 'Variation of data', 'Communication of death', 'Request for a certificate of codice fiscale', or 'Request for a duplicate health card'.

- In Quadro B, provide the necessary personal data. This includes information such as your last name, first name, gender, date of birth, and place of birth (commune or foreign state).

- Continue to Quadro C, where you will input your residency details. Complete the address fields including commune, street type, postal code, and house number.

- If you are a resident abroad, you must fill in the details in Quadro D, specifying the location of your residence and relevant postal information.

- In Quadro E, list any other codice fiscali that may have been assigned to you previously, if applicable.

- Attach any required documents indicated in the 'Allegati' section, ensuring that they are complete and clearly organized.

- Complete the signature section where you provide your codice fiscale, date, and signature to validate the request.

- If necessary, complete the delegation section, authorizing someone to submit the form on your behalf. Input their codice fiscale and complete the relevant details.

- Finally, review all entered information for accuracy, save your changes, and prepare to submit the form online.

Complete your form online today to ensure prompt processing.

Quanto costa l'aggiornamento del codice fiscale al PRA Il costo e di euro 42,74 in quanto verranno applicati gli emolumenti in misura ridotta e l'esenzione da IPT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.